From Seed to Soar

We are Growth Architects investing in Indian Leadership who are cultivating every dimension of public and private markets

Who we are

Ovington Capital is an investment firm based in Luxembourg with a forward-thinking vision to capitalize on the “Indian Century”

We partner with prestigious institutes such as IIT Madras, IIT Bombay, and T-Hub to access best-in-class startups and technical competencies in Deep Tech and AI-SaaS

Google DeepMind Visualizing AI Project

FAQ

When it comes to startups, our focus is on entrepreneurial teams working on ventures that leverage transformative technologies to create impactful solutions in Deep Tech and AI-SaaS in various sectors – HealthTech, Defense, Cybersecurity and Creative Industries (focus on Interactive Media & Gaming). We also help inventors build upon revolutionary ideas ranging from inventions to intellectual property (patents, design and copyright).

We typically focus on pre-product, pre-revenue start-ups with a strong vision and a dedicated team. However, our evaluation process is holistic, ensuring that promising ventures receive consideration regardless of their specific stage.

Ovington Capital Partners invests in India’s Private Markets by way of pre-product, pre-revenue companies. We also participate in Indian Public Markets by way of constructing a robust portfolio of stocks of established companies in growth sectors.

We actively promote collaboration within our participated ventures by facilitating networking, knowledge-sharing, and mentorship. We believe in the power of cross-fertilization of ideas (not just across domains and technologies, but also across markets) and encourage an environment where entrepreneurs, investors, thought leaders and mentors can collaborate and learn from each other.

Entrepreneurial teams interested in collaborating with us can submit their business proposals through the contact form on our website. Our team carefully reviews all submissions before contacting promising ventures for further discussions. We encourage teams to provide a comprehensive overview of their ideas in a detailed pitch deck in PDF.

Meet our Growth Architects

Governance

Marco Palacino

Managing Director

in Luxembourg

Marco Palacino is a Financier and Entrepreneur with a Master’s degree in Economics of Financial Intermediaries from the prestigious Bocconi University, Milan. With a remarkable career spanning thirty years in Asset Management, Private Credit, International Real Estate and Venture Capital, he now acts as the Managing Partner and Chief Investment Officer at Ovington Capital Partners.

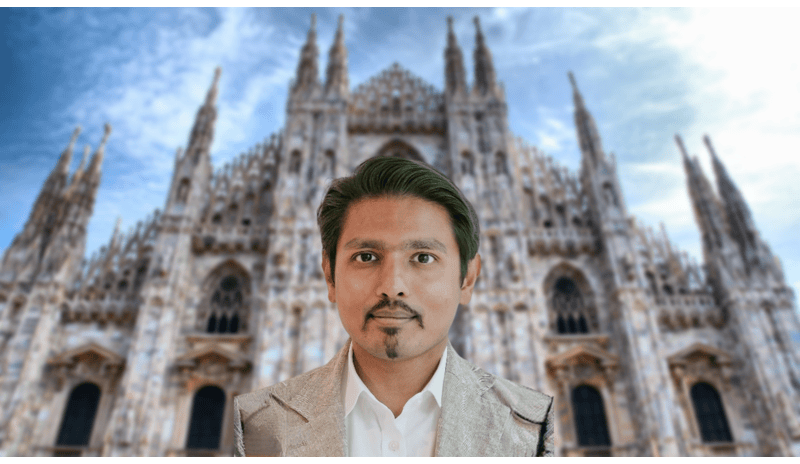

Praveen Radakhrishnan

Director

in Chennai, India

Praveenkumar Radhakrishnan leverages his 11+ years of international experience with exponential technologies in Corporate, Consulting and Start-up environments to contribute to the growth of Algram Labs Private Limited. His professional experience is backed by his M.B.A from Bocconi University, Milan, M.S. from University of Cincinnati, USA, and B.E. from BITS Pilani, India.

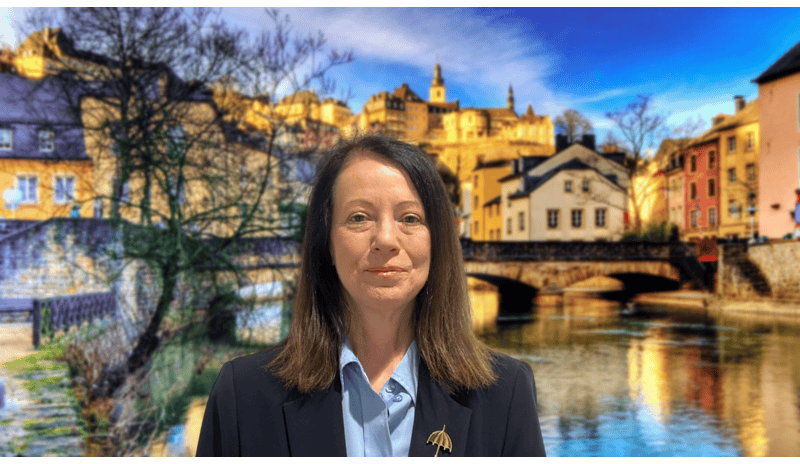

Elisabetta Luppi

Director

in Luxembourg

Elisabetta Luppi is Senior Corporate Officer at Ovington Capital Partners since its inception and is now Manager of the Company. She has extensive experience in Business Admin and Corporate Affairs, Compliance Assistance and Relationship Management.

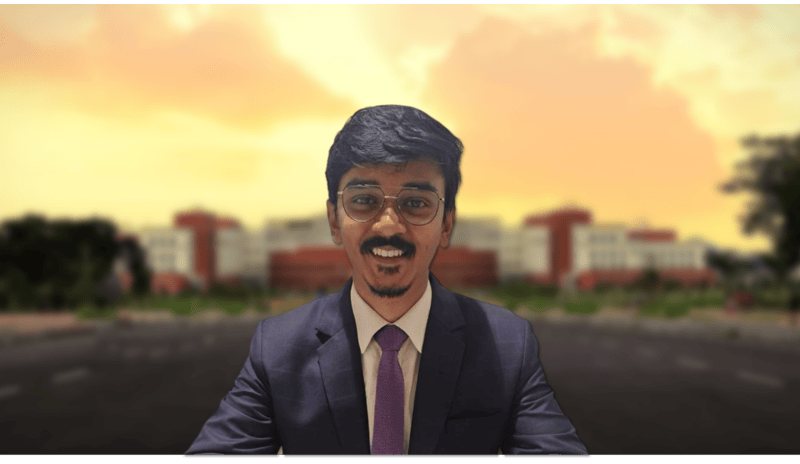

Rahul Radhakrishnan

Director, Algram Labs

in Chennai, India

Rahuldev Radhakrishnan is a seasoned entrepreneur with over 14 years of experience in Real Estate, Micro Finance, and Entertainment. His MBA from James Cook University, Australia, and mechanical engineering degrees underscore his expertise in Business Administration, Team Management, and Strategic Planning.

Analysts

Utkarsh Pratik

Business Analyst

in Chennai, India

Utkarsh Pratik, a graduate of SDA Bocconi Mumbai Campus’s International Master in Business program, holds a degree in law from National Law University, Ranchi. His passion for financial markets and startup ecosystem, and his analytical acumen, helps uncover opportunities supporting decision making.

Disha Sharma

Business Analyst

in Chennai, India

Disha Sharma, a graduate of SDA Bocconi Mumbai Campus’s International Master in Business program, has a background in finance complemented by experiences at EY, Mercer Consulting and Northern Arc Capital. She brings a profound zeal for startups and technology to her endeavors.

.

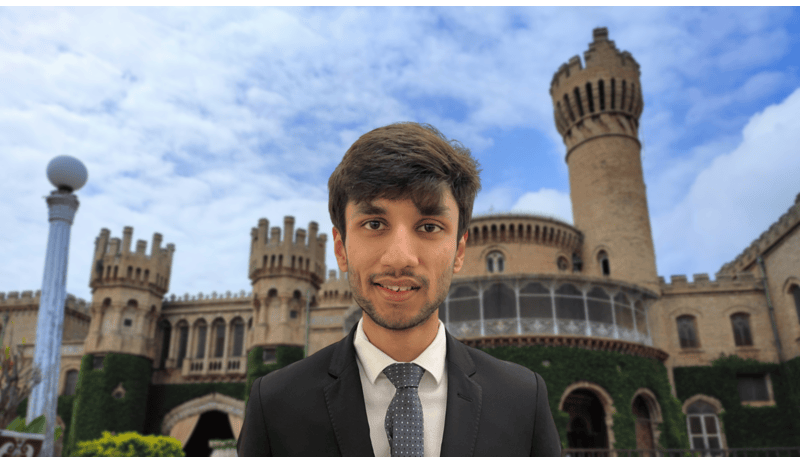

Parth Vora

Business Analyst

in Chennai, India

Parth Vora, a graduate of SDA Bocconi Asia Center, Mumbai, is a Business Analyst at Algram Labs. He holds a Chartered Accountancy degree and previously worked as an Assistant Finance Manager at ITC Limited. He completed his articleship at EY in Assurance. Passionate about finance, he enjoys outdoor activities.

Maheep Sidhu

Business Analyst Intern

in Mumbai, India

Maheep Sidhu holds an MSc in International Business Management from ESC Rennes School of Business. He is currently an Investment Analyst Intern at Algram Labs. With an engineering background and experience in Luxembourg’s financial consulting sector, he brings strong analytical skills and a passion for the venture capital industry.

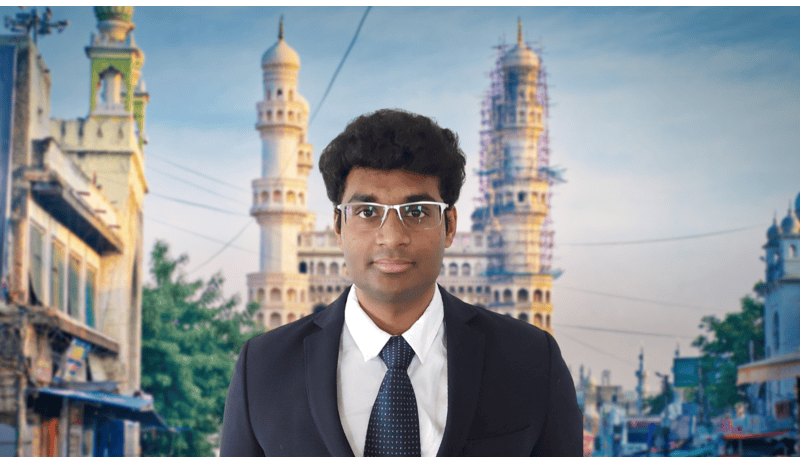

Charvak Thatha

Business Analyst Intern

in Hyderabad, India

Charvak Thatha is graduate from Bocconi University with a BSc in International Economics and Management. He is skilled in Financial Modeling & Valuations, and risk management of emerging economy investments. He served as an associate in Bocconi’s Space Technologies & Fintech student societies.

Let’s work together

Whether it’s a question or a pitch, feel free to reach out via the contact form and we’ll get back to you at the earliest possible.